One of the coolest things about Airbnb investing is that there are so many markets out there! There’s one in every state and city of the U.S. – and even the world! And there’s one to suit just about any business goal and budget there is!

The question is, which one should you put your money on?

In this post, we list down which markets are hot and which ones are quickly emerging. We’ll show you why – based on data provided by AirDNA, Mashvisor, and a few other authoritative sources.

When investing in short-term rentals, the thing to keep in mind is that markets can change from year to year. People’s travel patterns change, and corporate investments rise and fall. These can affect the housing supply and demand in a particular area, the seasonality, and, ultimately, your rental income.

Consider the past couple of years. Because of Covid-19, we saw bookings rise considerably in small cities and rural locations. Demand grew for glamping accommodations and unique stays.

So how do we know which markets are hot right now, and which ones will continue to be good in the years to come?

If you’re into Airbnb investing, these are the hottest Airbnb markets you should be adding to your bucket list:

Gatlinburg is one of the hottest Airbnb markets right now. It landed on the top spot of Lodgify’s 10 Best Places to Buy a Vacation Rental in 2022.

This small town receives massive amounts of tourists each year and you probably know why – it’s at the base of the Smoky Mountains. In fact, the whole area, including surrounding towns like Pigeon Forge and Sevierville, saw over 14 millions visitors last year because of the national park.

Gatlinburg is easily accessible because there are two airports nearby. It’s also close to other vacation spots like Asheville, North Carolina.

If you want start a business renting out cabins, Gatlinburg is the perfect spot. It has Airbnb-friendly laws, and occupancy rates are higher than average. The RevPAR is good because it’s a popular destination for families, couples, and bachelor and bachelorette parties.

If you can afford it, go for 4- or 5-bedroom cabins with scenic views, large decks, and the option to add a hot tub or a game room. That will help your listing stand out. If you add those five-star perks, you can potentially make around $80,000 a year – which is twice the market average.

Kissimmee is another hot spot for Airbnb investing. This city in Central Florida is less than half an hour’s drive from Orlando, which receives 75 million tourists each year because of Disney World and other world-famous theme parks. Families visiting Orlando choose to stay in Kissimmee instead because of the lower rent prices.

In the past year, the vacation rental industry in Kissimmee grew a sizable 36%. While the most popular rented properties are those with 4 or more bedrooms, a 2-bedroom apartment can make up to $24,842 each year.

This city has been topping Travel&Leisure Magazine’s Best U.S. Cities for many years now. In fact, it’s already in T&L’s Hall of Fame!

Charleston is the largest city in South Carolina and is known for great food, friendly folks, and lots of beaches. No matter where you go in Charleston, you’re never more than 20 minutes from a beautiful sandy beach.

But most of the city’s charm comes from its long history, cobblestone streets, horse-drawn carriages, antebellum mansions, and ever-friendly locals.

This city gets a high score for revenue growth, partly because more people want to rent larger homes. This has also driven the average daily rate up to $386.

In addition to the rise in revenues and rates, Zillow trends show that the average value of a home in Charleston, which is currently at $504,000, will continue to rise by 19%.

In 2021, Charleston had a 72% occupancy rate, which helped push the RevPAR to $148. That’s 48% more than it was in 2020!

AirDNA says South Lake Tahoe is one of the top 10 large US cities to invest in a vacation rental, with an annual earning potential of $62,187 when listed on Airbnb.

It’s been named one of the best lake towns, ski destinations, and all-around travel destinations in the US and the world. Because the area is so beautiful, it almost sells itself.

Visitors can hike on mountain trails, relax on South Lake Tahoe’s beaches, ski down Squaw Valley’s slopes, or eat gourmet food in Incline Village. During the summer, tourists flock there to jet ski, parasail, hang glide, or bungee jump.

Homes in the area go up in value quickly, so you’ll be fine if you want to sell your property in the future. Properties in South Lake Tahoe usually sell in 30 days and when they’re on the market, they normally get two offers.

But the area is vast, and each neighborhood has its own feel and scenery. Look for a waterfront property because most vacationers want to be by the water.

Yet another in the top Airbnb markets is still in the Southeast. Savannah, Georgia has a lot of art, history, great food, unique architecture, natural scenery, and you might’ve heard – ghost stories. Yes, it’s the most haunted city in the U.S.!

But this coastal town is one of the “friendliest in the world”, according to Condé Nast Traveler.

Known for their Southern hospitality, folks down in Savannah say if you go into any old building or cemetery there, it’s very likely you’ll see ghosts. So if your guest happens to be a ghost hunter, tell them they could see some very real paranormal activity!

Savannah is also close to an airport and has a layout that’s very walkable. The Historic District, built in the 18th century, has more than 20 cobblestone blocks lined with old mansions and churches, well-kept gardens, and parks shaded by moss-covered oaks.

Another attraction is the Savannah River where people go kayaking and look for bottlenose dolphins, egrets, herons, and other wildlife.

STR investors love peaceful Savannah because the market is affordable. It has a cap rate of 9%, a median home price of less than $280,000, and a lot of homes for sale. RevPAR went up to $141 in 2021, which is an incredible 58% surge.

Again, if you want to invest in this city, look for riverfront properties or those near the historic areas.

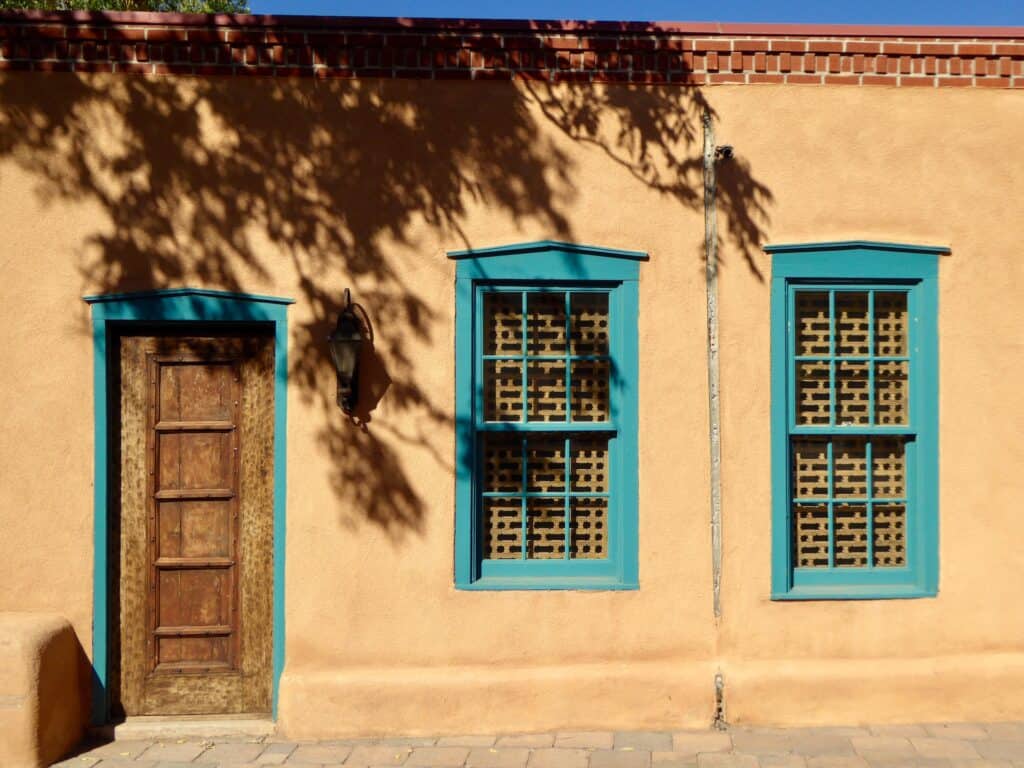

This city has consistently high nightly occupancy rates. But you’d be surprised – there are only less than 2,000 listings in Santa Fe on Airbnb! The market there is still growing so now’s a good time to jump in!

Even though it’s 7,000 feet above sea level, Santa Fe is still a hot spot because people can hike, bike, raft, fly-fish and get sun all year long. Plus, it’s only within a few hundred miles of a number of big cities in both the US and Mexico, so property owners can get a lot of tourist traffic from both countries.

Santa Fe is in the foothills of the Sangre de Cristo Mountains and is often included on Travel & Leisure’s Best American Cities list. It’s called “The City Different” because it really does look different. Houses are built in the Spanish Pueblo style, with a combination of Native American influence. So the general vibe is a mix of Anglo, Hispanic, and Native American flavors.

And when it comes to culture and the arts, Santa Fe’s art scene boasts the third-largest art market in the country. It has more than 250 galleries and more than a dozen museums.

Check out the Pecos real estate market in Santa Fe which is quite affordable. The homes have been updated and are kept in great shape. And many of them have scenic views of the river.

As shown by its 55% spring to $168 RevPAR, Santa Fe is a great place to invest in short-term rentals.

Big Sky is a tried-and-true vacation spot for outdoor lovers. In the summer, families love to hike, bike, and camp at Yellowstone National Park. In the winter, adrenaline junkies congregate on its rugged slopes for world-class skiing and snowboarding. So the area is a profitable investment year in and year out.

Prices for STR stay are rising, jumping 29% to $302 on average. RevPAR in 2021 was at $187, a 48% rise from the previous year.

Joshua Tree is in the Mojave Desert, north of the West Entrance Station to Joshua Tree National Park. It’s about a three-hour drive from San Diego, Los Angeles, and Las Vegas – an easy trip to an amazing landscape that can’t be found anywhere else. Every year, millions of people visit Joshua Tree’s vast, other-worldly landscape.

In 2021, occupancy stayed at a good 62%. A price increase of 28% per year led to a 20% increase in RevPAR or an average of $164. Which isn’t bad for a mostly empty country with only a few small towns.

AirDNA gave Joshua Tree a high invest-ability score because the average home price there is $343K and the average income is $85K per year. A high rating (97) was also given for rental demand.

It’s interesting to note that markets around Joshua Tree do very well, too. Over the past year, the number of booked Airbnb listings in nearby Yucca Valley went up by 58%.

If you’re looking to invest in this area, consider getting bigger properties. Larger homes have more than three times the income potential of smaller homes, but they cost relatively less to buy.

Maui has high occupancy and strong revenue growth. It’s pretty easy to run STRs there because Maui short-term rental laws are pretty friendly. They allow landlords to lease their properties remotely.

Also known as “The Valley Isle”, Maui is the second-largest Hawaiian island famous for its tropical beaches, great surf, whale-watching, and golden sunsets.

Because tourism is Maui’s backbone, real estate there is very expensive. It’s a high-demand market with a supply that’s very low. But as an investor, you know there’s an upside to that. Appreciation rates are steady, so if you invest there now, it’s only a matter of time before you reap the rewards.

With an average daily rate of $375, the average full-time rental property in Maui makes $102,000 per year.

Look for properties in the Lahaina and Wailuku areas. According to AirDNA, Lahaina STRs on Airbnb and Vrbo enjoy 90% occupancy.

Phoenix has been the fastest-growing big city in the United States over the past decade. Migrants keep moving in from other states and metros, lured by lower taxes, lower cost of living, and great livability. The Valley was the most popular migration destination in 2021.

Tourism has rebounded, too. According to Airbnb, Phoenix was the 3rd most profitable area for new hosts on the platform for the first half of 2021.

Aside from that, the city is quickly becoming the next tech boom town. Companies like Lucid and Nikola Motors, Taiwan Semiconductors, Weebly, Gainsight, and Silicon Valley Bank have set up operations there.

Compared to Austin, TX, Phoenix has a lot more space and real estate is cheaper. The value of homes has been skyrocketing and demand keeps outpacing supply. Rent prices are soaring, too.

Greater Phoenix is home to one of the largest municipal parks in North America, South Mountain Park. With over 16,000 acres, it offers 50 miles of hiking, biking, and horse trails. And of course, Arizona state is home to the Grand Canyon.

You’re unlikely to go wrong investing in Phoenix. It’s a great time to be in that market – whether you’re buying or selling. In fact, if you already have property there, and want to upgrade, now’s a good time to sell. The Valley saw around 100,000 home resales in just the past year.

Now here are a few sleeper areas that, surprisingly, made it to the top of 2022’s charts:

Mashvisor actually put this small town at the top of its 10 Best Places to Buy STR Property in 2022. Pulaski is in the middle of the New River Valley, which is near Claytor Lake State Park where tourists go boating, fishing, swimming, hiking, and picnicking. It’s also near New River Trail State Park which has a 57-mile linear park along an old railroad bed popular with off-road cyclists.

Downtown, people flock to Thee Draper Village to eat, shop, and attend events like weddings.

The price to rent a place in this scenic Virginia town is $241 per day. The prices of homes are low, around $144,000 on average, which is great for first-time investors. The return on cash is 9.88%.

Not all of the best Airbnb markets are beaches, deserts, or historical towns. The Kenai Peninsula up north in Alaska is actually AirDNA’s #2 Best Place to Invest in.

It’s a great place for people who want to experience the majesty of Alaska’s wilderness, with easy access to national parks, fjords, wildlife viewing, and world-class salmon fishing.

Before the pandemic, occupancies averaged 60% in the summer. In 2021, that number swelled to over 80%. AirDNA gave Kenai Peninsula a score of 94 for revenue growth because of this.

The average home value in Kenai is $237,000 and the average revenue is $44,000. Look in Seward and Soldotna areas. Both are less than three hours from Anchorage. They have high invest-ability, and both saw strong demand and rising income in 2021.

If you like New Orleans, then consider the nearby town of Slidell instead. It’s just 40 minutes from both the French Quarter and the casinos and beaches of the Mississippi Gulf Coast.

Just like neighboring NOLA, Slidell has high scores for revenue growth and invest-ability. The historic Old Towne district has Southern charm and friendliness, and the nearby Honey Island Swamp is full of adventure.

A short-term rental in the area costs an average of $339 daily rate. Those nights can add up to a high annual income of $69K, which isn’t bad for an area where the average home price is $225K.

Choosing the right location is one of the best things you can do for your Airbnb investments. With the above information, you can now narrow your search and start the process of buying a short-term rental, with the ultimate goal of making good, passive income.

As always, do your due diligence. Research, study, and compare data as much as you can. And do some serious math. That way, you can estimate how much income and ROI you can expect in the years to come.

Ready to learn how we built and operate a $2M/year short-term rental business, operate properties throughout the USA remotely, and acquired 70+ properties without owning any in just 2 years? Attend our free online master class to learn how you can do the same. Click here.